Bollinger bands had been evolve through john bollinger as a technical trading tool within the early nineteen eighties. They

arose from the need for adaptive buying and selling bands and the observation that volatility turned into no longer static as changed into broadly believed, but dynamic. Bollinger evolved the method of the use of transferring averages with two buying and selling bands. This is not unlike using an envelope on both side of a transferring average. But, unlike using a percent computation from a normal transferring average, bollinger bands upload and subtract a preferred deviation calculation.

Bollinger bands are use to offer a definition of relative high and occasional. That is a demonstration of prices being “excessive” at one cease and “low” at the alternative cease. The use of this definition can resource in spotting rigorous styles and is useful inside the assessment of price motion to indicator action when arriving at systematic trading choices.

Additives

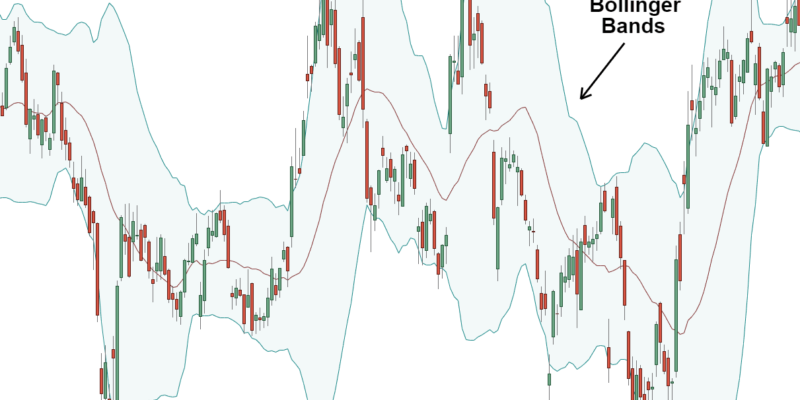

Bollinger bands consist of a centerline and two charge channels. One charge channel is above the centerline, and the opposite is underneath the centerline. This centerline is an exponential shifting average. The rate channels are wellknown deviations of the stock being studied by using the chartist. Consequently, the definition of a “fee channel” on this regard refers back to the encompassment of the trading hobby around the fashion of buying and selling after a sharp rise or fall in the market. The bands will amplify and agreement as the charge movement of an difficulty will become risky (this is enlargement) or becomes bound into a tight buying and selling pattern (the definition of contraction).

The center bollinger band equals a 20-length moving common. The top bollinger bands includes the center bollinger band plus the total of two 20-period preferred deviations. The lower bollinger band is equivalent to the middle bollinger band minus the whole of two 20-period general deviations.

What bollinger bands degree

Important gear are spinoff of the bollinger bands. Bandwidth, which is a relative measure of the width of the bands, is the first device. Bandwidth is calculate via dividing the end result of the top bollinger brand minus the decrease bollinger band with the aid of the center bollinger band. This is most usually use to quantify “the squeeze, ” volatility based buying and selling opportunity. The second one tool derived from bollinger bands is %b. This is a measure of where the closing charge is in relation to the bands. That is calculate by way of dividing the result of the last minus the decrease bollinger band via the upper bollinger band minus the decrease bollinger band. %b is most usually use to make clear buying and selling patterns. It’s also use as an input for trading systems.