Forex trading, also known as foreign exchange or Forex No Deposit Bonus, is the process of buying and selling currencies with the aim of making a profit. It’s a dynamic and decentralized global market where currencies are traded. Understanding the basics of Forex trading is essential for anyone looking to venture into this lucrative yet volatile financial market.

What is Forex Trading? Forex trading involves the simultaneous buying of one currency and selling another. Currencies are always traded in pairs; for instance, EUR/USD (Euro/US Dollar) or USD/JPY (US Dollar/Japanese Yen). The first currency in the pair is the base currency, while the second is the quote currency. The value of a currency pair represents how much of the quote currency is needed to buy one unit of the base currency.

Key Players in Forex Trading:

- Banks: Major financial institutions engage in Forex trading, facilitating a significant portion of the market.

- Central Banks: They play a crucial role by setting interest rates and controlling monetary policies affecting currency values.

- Hedge Funds and Investment Firms: These entities trade on behalf of their clients and investors, impacting market movements.

- Retail Traders: Individuals like you can access the Forex market through brokers, trading platforms, and online tools.

Understanding Currency Pairs: There are three types of currency pairs:

- Major Pairs: These include the most traded pairs and involve currencies of major economies like EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

- Minor Pairs: Pairs that do not include the US dollar, such as EUR/GBP, AUD/JPY, and GBP/JPY.

- Exotic Pairs: These involve one major currency and one from a developing or smaller economy, like USD/SEK (US Dollar/Swedish Krona) or EUR/TRY (Euro/Turkish Lira).

Factors Influencing Forex Markets: Several factors influence currency prices, including:

- Economic Indicators: GDP, employment rates, inflation, and other economic data impact a country’s currency value.

- Geopolitical Events: Political instability, elections, and geopolitical tensions can affect currency markets.

- Central Bank Policies: Monetary policies and interest rate decisions influence a currency’s strength or weakness.

- Market Sentiment: Trader perceptions and market psychology also drive currency fluctuations.

Getting Start in Forex Trading:

- Education: Acquire knowledge through reputable sources, courses, and educational materials to understand market dynamics, technical analysis, and risk management.

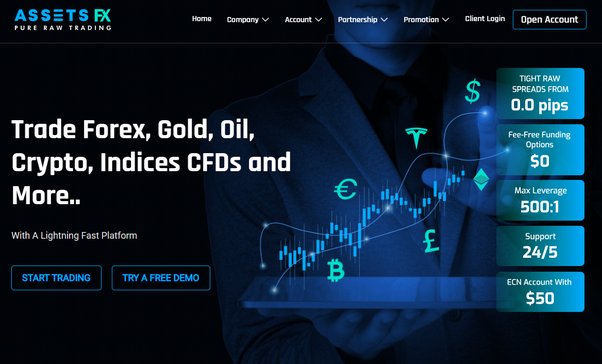

- Choose a Reliable Broker: Select a regulated and reputable broker offering a user-friendly platform, competitive spreads, and essential tools.

- Develop a Trading Strategy: Define your trading goals, risk tolerance, and strategy—whether it’s day trading, swing trading, or long-term investing.

- Practice with a Demo Account: Most brokers offer demo accounts to practice trading with virtual money before risking real funds.

- Start Small: Begin with a modest investment and gradually increase as you gain experience and confidence.

Risk Management in Forex Forex No Deposit Bonus : Managing risk is crucial in Forex trading. Strategies include setting stop-loss orders, proper position sizing, diversification, and avoiding emotional decision-making.

Conclusion: Forex Forex No Deposit Bonus offers vast opportunities but requires diligence, education, and a disciplined approach. By understanding the basics, keeping updated on market trends, and employing sound risk management strategies, individuals can embark on a rewarding journey in the world of Forex trading.