Harmonic Patterns: Most of the people get into buying and selling and making an investment because they want to make loads of cash. And considering that this is their aim, they quickly begin to search for the most profitable technique they are able to locate. They commonly begin by using reading all of the different freely to be had indicators. Lots of those signs have more than one methods to used, that could certainly confuse the dealer even extra. For example, with macd, do you purchase when the quick line crosses the gradual line. Or when the quick line crosses the zero line, or a few different way? Ask 10 investors and you may probably get 10 special solutions.

That is one of main motives why most people eventually forestall the use of indicators. The opposite purpose is due to the fact they’re now not making any cash with them.

At this factor many people either surrender, or flip to other techniques.

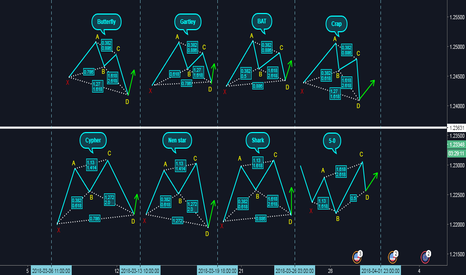

Harmonic buying and selling is one non-indicator technique use to change profitably in the marketplace. This method uses “harmonic patterns” that are a aggregate of charge patterns and fibonacci ratios to perceive reversal, entry, and exit factors within the marketplace. They contain particular prevent loss factors and exit factors, so unlike with signs. There may be not anything vague approximately what you are doing.

Harmonic trading may use on any time frame, whether you favor to alternate intraday. Each day, weekly, or on some other time frame you decide upon. Due to the fractal nature of the markets, anything that works on one time body will work on any of the opposite time frames as well. Many humans like to change on longer timeframes, but, due to the fact doing so calls for much less leverage. And additionally does not require constantly tracking of the market all through the day.